DMV.org Insurance Finder

Arizona Car Tax Title And License Calculator

Join 1,972,984 Americans who searched DMV.org for car insurance rates:

Shopping for a used car requires serious financial decisions. Not only must you decide on how to finance the vehicle, but you must also take into account:

Title Fee Calculator. Whether you’re creating a Net Sheet, calculating a Good Faith Estimate, or simply need to calculate title rates and fees, let First American’s intuitive rate calculator be your guide. Our simple-to-use design allows you to get the title rate information you need – when you need it. Calculating the Arizona Vehicle License Tax (VLT) Calculator Calculate Formula Equation An “Arizona Certificate of Title” will indicate the month and year of the first time the vehicle was registered in Arizona (“First Registered”).

- Paying for car insurance.

- Paying for a smog check, if applicable, and possible modifications to make the vehicle compliant.

- Vehicle tax (depending on your state it may also be referred to as sales tax, use tax, road tax, or axle tax).

- Vehicle registration.

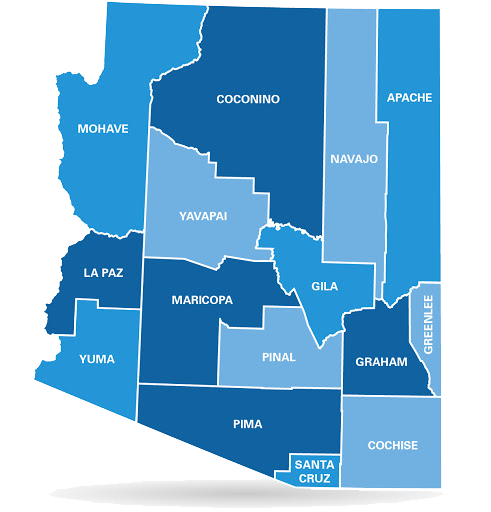

Complicating the matter is that the latter two costs are often difficult to gauge. Vehicle tax rates vary by state, county, and even municipality.

Plus, the criteria for determining vehicle registration fees for used cars differs from state to state. New York, for example, bases the fee on a vehicle's weight, while Colorado employs a complicated formula based on the vehicle's year, weight, taxable value, and date of purchase.

Realizing the difficulty used car buyers face in properly assessing registration and tax costs for used vehicles, many independent and Department of Motor Vehicle (DMV) websites now provide online vehicle tax and tags calculators.

What Does Tax Title And License Cost In Arizona

Vehicle Tax Costs

Vehicle tax or sales tax, is based on the vehicle's net purchase price. It's fairly simple to calculate, provided you know your region's sales tax. If you are unsure, call any local car dealership and ask for the tax rate. Dealership employees are more in tune to tax rates than most government officials.

Once you have the tax rate, multiply it with the vehicle's purchase price. For example:

$2,000 x 5% = $100.

You can do this on your own, or use an online tax calculator.

Car Registration Fees

Given the complexity in determining vehicle registration fees, it's best to use an online calculator, or what some state's refer to as a Fee Estimator. (Even DMV officials have difficulty in determining exact registration fees, thus the name 'estimator.' ) The process is easy, requiring entering pertinent information like vehicle identification number (VIN), purchase amount, and license plate type.

If your state's DMV website does not provide an online calculator, you can find one on many car-related websites. These calculators are not exact, but can, at the very least, provide you with an estimated figure simply based on your state and estimated purchase price. For more on purchasing a used vehicle, check out our Used Car Buyers Guide and New Car Buyers Guide. You'll find both in our Buying and Selling section.