Posted 30 December 2015 under Tax Q&A

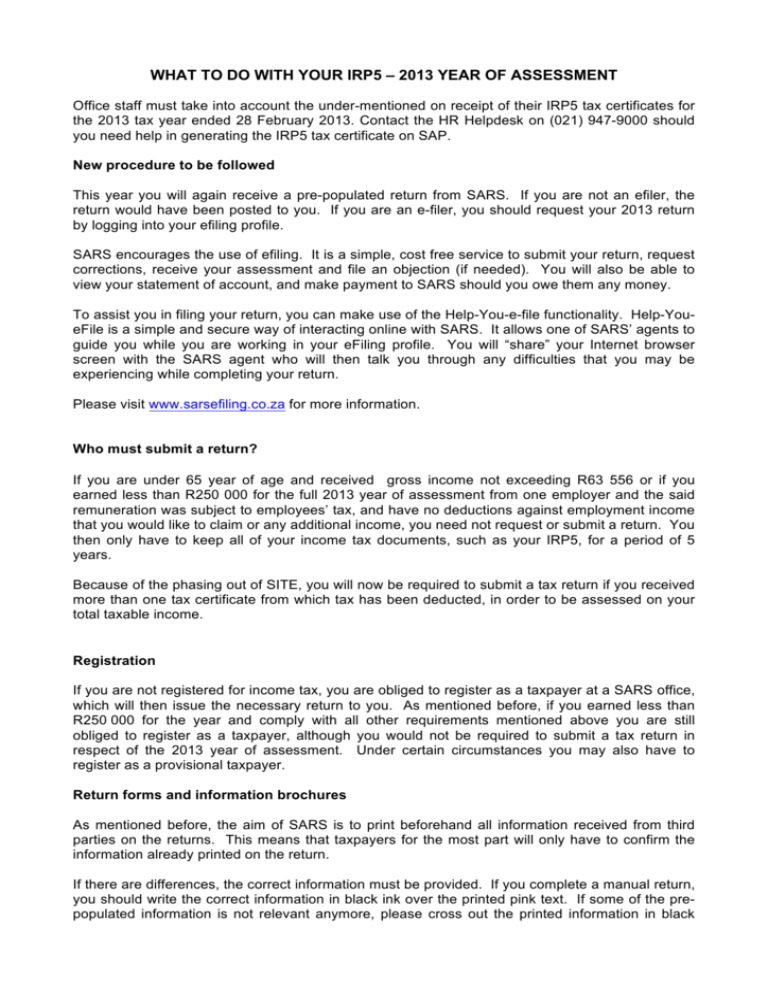

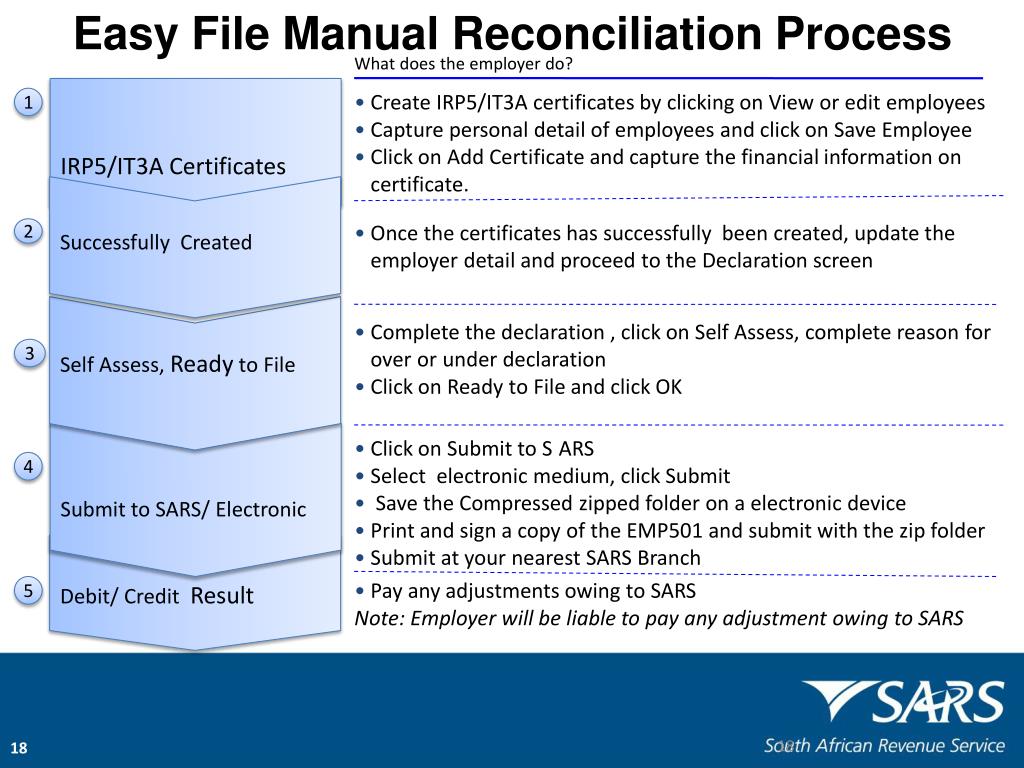

SARS Submissions. Employers are required, twice a year, to reconcile their IRP5 / IT3 (a) tax certificates; the EMP201/EMP501 statements; and the actual payments made to SARS, by using the e@syFile software provided by SARS. The February 2021 reconciliation relates to the full 2021 tax year (March 2020 – February 2021). SARS uses a special secure PDF file (PDFXFA) which you can only open in specific programs (Internet Explorer and Adobe Reader). If you are having trouble viewing the document you can follow these steps: 1. Go to the PDFXFA website. Tap the box where it says 'Click here to select the file'. Select the SARS PDF file from your device. At the end of each tax year, employers must issue tax certificates to all employees who worked during the tax year (March to February). Employers must also send copies of the tax certificates as well as a reconciliation to SARS. You can generate tax certificates and the file to import into e@syFile once. In partnering with SARS to work towards our vision, the employer plays a critical role. This guide will help you to fulfil your tax responsibilities to ensure that you have a smooth Employers Tax Season. For further information, please visit a SARS branch, call the SARS Contact Centre on 0800 00 SARS (7277) or visit www.sars.gov.za.

| Rinkisays: 16 December 2015 at 8:02 If we change the service provider for payroll process and the current service provider is not releasing or accepting in easy file. How the new service provider can access to file EMP201/501. This entry was posted in Tax Q&A and tagged Salary / IRP5. Bookmark the permalink. |

Employers are required, twice a year, to reconcile their IRP5 / IT3(a) tax certificates; the EMP201/EMP501 statements; and the actual payments made to SARS, by using the email protected software provided by SARS. The February 2021 reconciliation relates to the full 2021 tax year (March 2020 – February 2021).

| TaxTimsays: 30 December 2015 at 22:40 There is not transfer request on easyFile because it is a desktop software, you will need to transfer the backup file manually. |

This articleis to assist you with all the IRP 5 codes needed to submit your EMP 501reconciliation. This is not a complete list, but the most important and most used ones.

Income codes:

3601 -Normal salary income

3605 -Annual payment (bonus)

3606 -Commission income

3610 -Normal salary income

3615 -Member's remuneration (Closed Corporation) / Directors remuneration (Company)

3616 -Independent contractor

3617 -Labour broker

Allowance codes:

3701 -Travel allowance

3702 -Travel reimbursement (taxable)

3703 -Travel reimbursement (non-taxable)

3715 -Subsistence allowance

Fringe benefitcodes:

3801 -General benefit

3802 -Company vehicle / right of the use of a motor vehicle

3805 -Cheap or free accommodation

3810 -Company medical aid contribution

Grossremuneration codes:

3696 -Gross non taxable income

3697 -Gross retirement funding employment income

3698 -Gross non-retirement funding employment income

Deduction codes:

Download Easyfile

4001 -Pension fund contributions (current)

4002 -Pension fund contributions (arrear)

4003 -Provident fund contributions (current and arrear)

4005 -Medical aid contributions

Sars Easyfile Login

4006 -Retirement annuity fund contributions (current)

4007 -Retirement annuity fund contributions (arrears)

4474 -Employer's medical aid certificate

Employee's taxdeduction codes:

4102 -PAYE

4116 -Medical aid credits

4141 -UIF employer and employee contributions

4142 -SDL employer contributions

4149 -Total PAYE / UIF / SDL contributions

Read more about the services we offer:

Monthly bookkeeping services

Annual financial statements

Sars Easyfile Login

| Subscribe to your YouTube Channel: |

| 21 Day Online Course - Morning Rituals & Daily Habits (Entrepreneur SA): |

| FREE Gift Pack - Subscribe to our Newsletter (Entrepreneur SA): |

| Like us on Facebook (22,245 Likes) (Accountants & BEE South Africa) |